Express News Service It is amazing to see the kind of risk that people take with medical insurance! Or rather the...

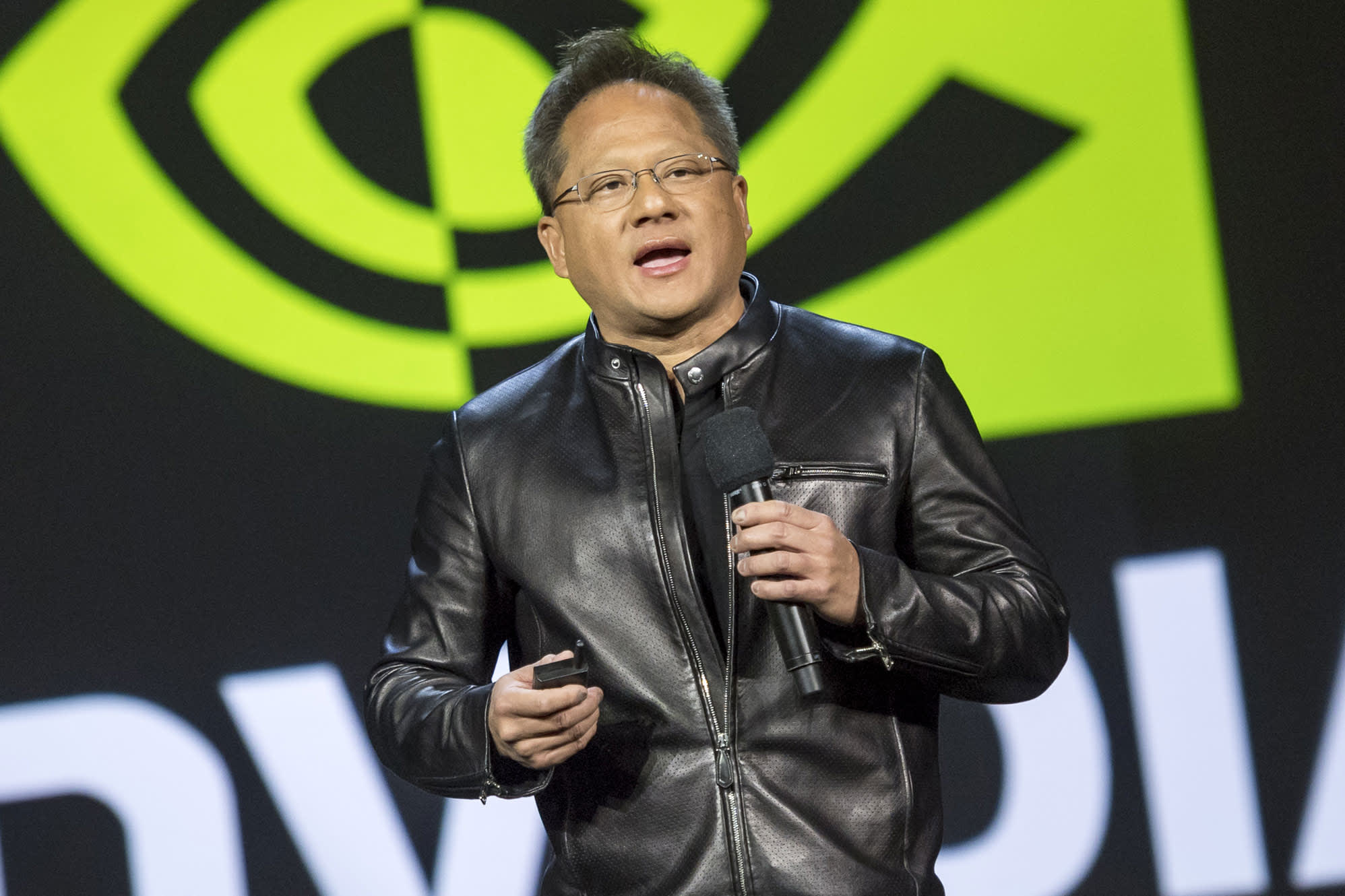

It's Nvidia's moment of truth.The semiconductor company is set to report earnings Wednesday afternoon. This comes after the stock has...

Whether you agree with the idea of reopening schools or not, distance learning will soon be the norm. The old-fashioned educational...

The Securities and Exchange Commission today adopted amendments to the “accredited investor” definition, one of the principal tests for determining...

NEW YORK — The period in which New Yorkers can enroll in health insurance has been extended another 30 days,...

DBS describes the growth of digital currency as both fascinating and daunting in a new research paper, 'Digital Currencies: Public...

CLOSE The U.S. Postal Service is facing record demand because of COVID-19 and the upcoming election. Does it have the...

COVID-19 is wreaking havoc on Americans’ mental health. One in three Americans now suffers from severe anxiety, and one in...

Financial advisors are increasingly turning to robo advisors, technology platforms that not so long ago were viewed as fierce competition.At...

EATONTOWN, N.J., Aug. 19, 2020 /PRNewswire/ -- Crum & Forster, Accident & Health (www.cfins.com) announces that Pethealth Inc. (www.pethealthinc.com) will complete a...