Five Real-Time Charts Show Signs U.S. Economic Recovery Is Faltering

3 min read

(Bloomberg) — The U.S. recovery from the coronavirus-induced recession is leveling off and showing signs of faltering only two months into the rebound, a series of real-time economic indicators show.

While the official economic data have been surprising to the upside – including a gain of 4.8 million jobs in June – newer trends suggest those improvements are flattening or even turning down.

With cases rising in Arizona, California, Florida, Georgia and Texas, some states are imposing new restrictions on activity or pausing reopening plans. Federal Reserve officials including Atlanta Fed President Raphael Bostic and Cleveland Fed’s Loretta Mester warned this week the accelerating spread of the virus poses new risks.

“People are getting nervous again,” Bostic said.

Real-time economic data from five private and government sources show the economy “looking worse,” said Neil Dutta, head of economics at Renaissance Macro Research. The summer pause isn’t likely to be an extended slump, but rather suggests a “stair-step” recovery with pullbacks along the way, he said.

Read More: U.S. Jobless Claims Fall While Corporate Cuts Signal More Pain

Here are five indicators of the recent slump:

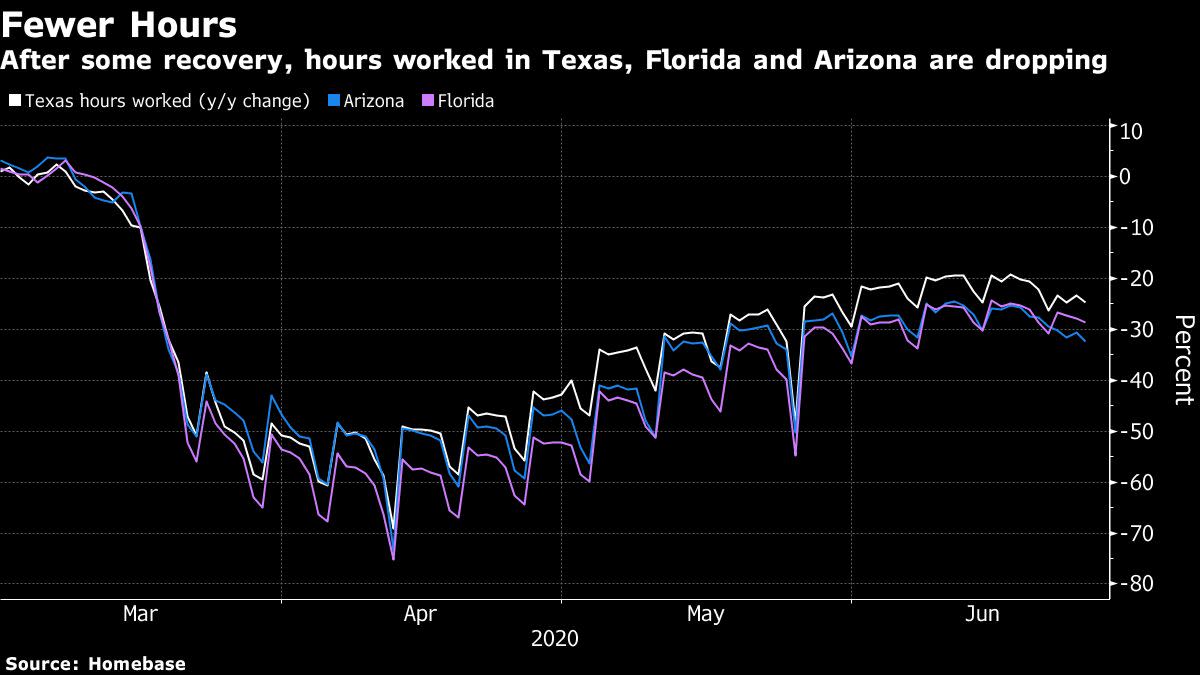

1. Texas-Florida-Arizona Jobs

Bostic cited Homebase data as among the real-time reports he’s seeing that show a leveling off of the economy, with a stagnating number of businesses opening and employees working. That’s particularly evident in states where the virus has been surging, including Florida and Texas. Homebase, a free scheduling tool used by 60,000 U.S. businesses and a million hourly employees, had shown the labor market gradually improving through mid-June.

2. U.S. Employment Rate

The Dallas Fed publishes a real-time survey of the population to gauge the percentage of Americans who are working, using Current Population Survey data. The upshot? The percent figure rebounded in May but recently started to level off.

3. Restaurants

Eateries across the U.S. shut down in March in response to government lockdowns and consumers staying home as the virus spread. Restaurant reservations on Open Table, an online service, showed a pickup in May and the first half of June, followed by a drop during the last few weeks. The decline has been especially marked in places with rising cases, though it’s happened in other states as well.

4. Weekly Economic Index

The New York Fed launched a weekly index in April to give a more timely measure of the economy during the Covid-19 crisis. The components include measures for same-store retail sales, consumer sentiment, initial unemployment-insurance claims and steel production, among others. The gauge showed a big rebound in May and early June, but Dutta includes this index among the indicators getting worse.

5. Housing Stress

Homeowners remain under continued pressure and there are signs things could get worse, according to the U.S. Census Bureau’s Household Pulse Survey. Nearly one in 10 households with a mortgage failed to make their last payment and 16% of the survey respondents said they fear they can’t cover the next one, according to the U.S. Census survey in data collected in late June.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.