<strong>Ryan Ermey</strong>: With the fall semester fast approaching, the COVID-19 pandemic has cast a shadow of uncertainty over higher education....

save

Click here to read the full article. The United Kingdom may soon require an online sales tax.According to multiple reports,...

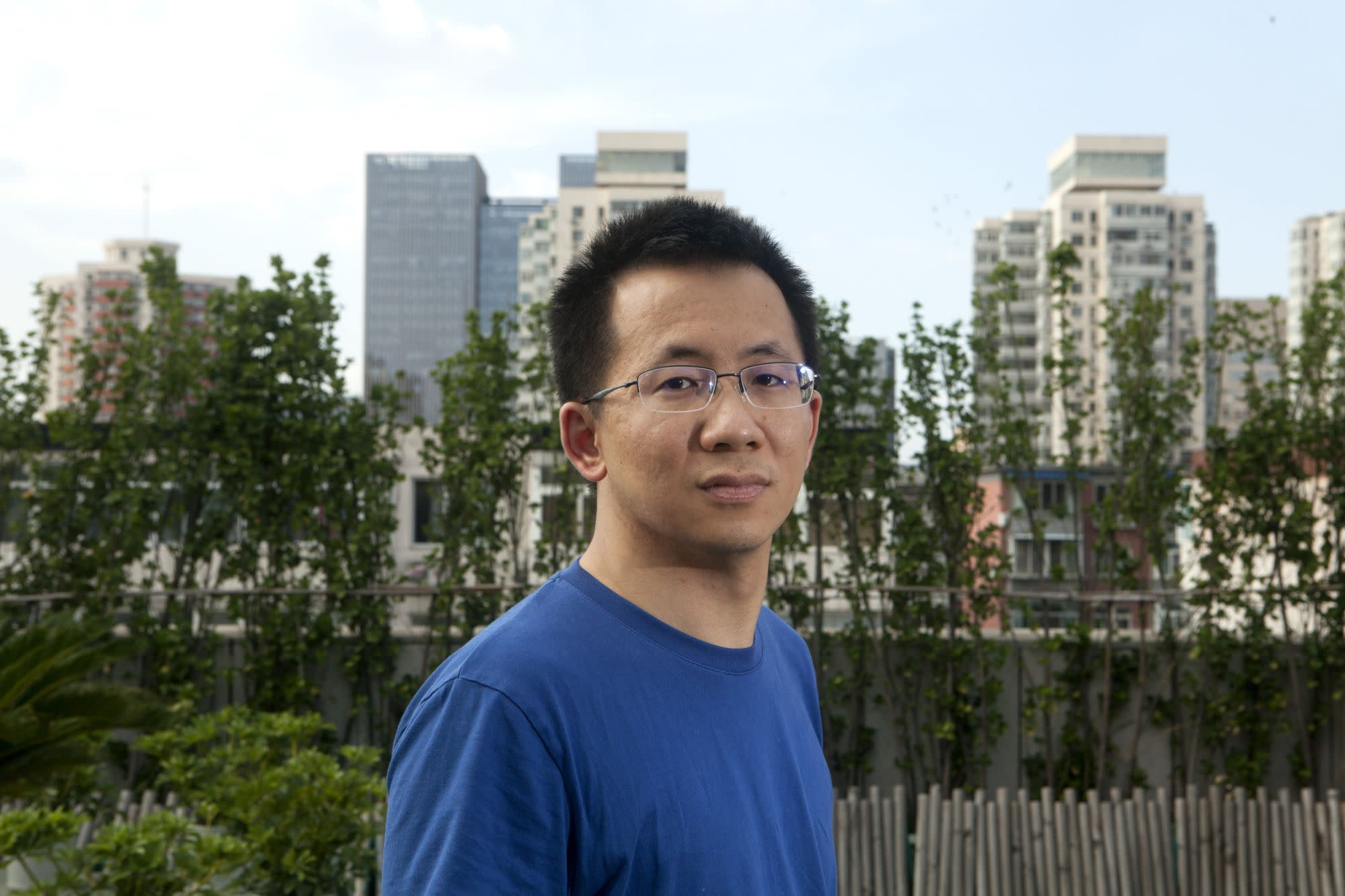

(Bloomberg) -- Zhang Yiming is the little-known Chinese entrepreneur who built TikTok into one of the most promising franchises on...

If it seems like the world is getting more expensive, that’s because it is. The cost of consumer goods is...

Does it seem like your hard-earned paycheck isn’t stretching as far as it should be? Fortunately, there are a few...

President Donald Trump’s weak poll numbers and a surge of Democratic cash flooding key Senate races have jolted top Republicans...

Hannah Betts hits the (virtual shops) testing John Lewis's new online personal shopping serviceI am sitting in my flat in...

fizkes/istockphotoTime to Save OnlineNow more than ever, as the country finds itself in a pandemic-induced recession, saving money has become...

While the coronavirus pandemic has been financially devastating for the almost 45 million unemployed Americans across the country, there's been...