How to keep track of your finances as a student

5 min read

Golden rules

First, and possibly the simplest: Your income needs to add up to more than your spending. If it doesn’t, you’re spending money you don’t have.

Second: Following on from the first, you shouldn’t be getting into unnecessary debt. Credit cards offer the temptation of a spending spree, with the pain of payment deferred for months (or even years), but don’t fall into that trap. That new item of clothing may seem great now, but it won’t be nearly as enticing when you’re paying 20 percent interest on it long after you donated it to Goodwill.

True story: In my first year of college, I knew two people who got suckered in by those too-good-to-be-true credit card deals. The repayment terms were generous and the interest rates low, and the temptation was too tough to resist and one of them racked up a debt of nearly $37,000 in a year. Both had to quit school and get jobs because their parents couldn’t, or wouldn’t, bail them out. Just say no, folks.

Third: It’s always smart to set yourself a budget and, again, with the exception of a serious emergency, never break it. Maybe you have the hookup to get cheap Coachella tickets, or maybe you could really use one more Seamless takeout order. But with any purchase, channel your inner Marie Kondo and ask if you really need this thing in your life and if there are cheaper alternatives.

Budgeting 101

That said, setting a budget can be hard. It asks you to be mindful of your regular spending and face your own behavior. But the end result is that you’ll be able to understand where your cash goes and if you’re making the best use of it. Use your budget as a way of learning where your weak spots are so you can set rules to combat them in the future.

An easy first tactic is to work out how much cash you expect to have on hand for the year and what your fixed costs are. If you don’t know what a fixed cost is, ask yourself what bills you need to pay to avoid getting your heating shut off or getting kicked out of your dorm. Break it down either on a weekly or monthly basis, depending on how much detail you need.

Then make a list of costs that, while not fixed, you need to pay on a regular basis, like food and drink, transportation and study supplies. Plan how much you’d expect to spend in a good week or month and turn it into a fixed target, giving you a clear set of rules.

If you’re struggling with this, remember that your spending must be less than your income so it’s time to make some tough decisions. If you can’t afford to ride the subway to school, you’ll need to look at cheaper alternatives or cutting back in another area. And don’t forget that you should account for emergencies, regular savings and, if you’re flush, maybe a small investment or two.

There’s a cottage industry of media pundits talking about how “darn kids” are wasting their money on avocado toast and lattes. It’s world-class bull, because the dollars spent on drinking a $3 latte every day may be the only fun you have. You should include room in your budget for fun, or else what’s the point of living? Set a (small) figure that you can afford, spend it on something pleasurable and ignore the people who expect you to toil in abject misery your whole life.

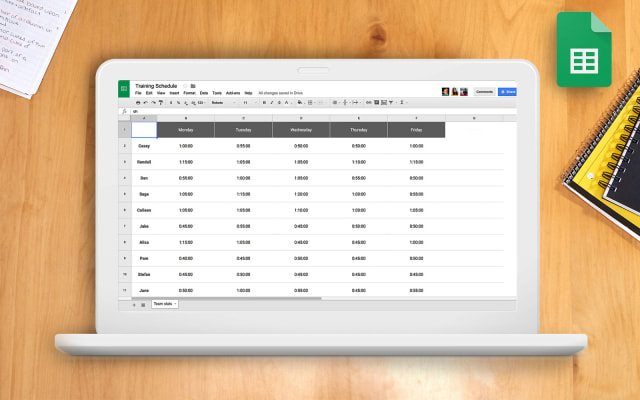

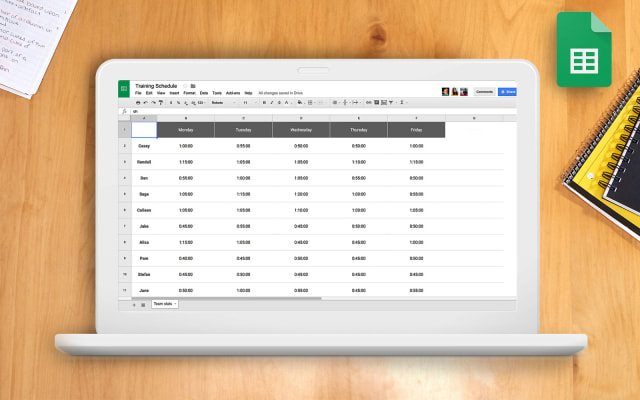

Google Sheets

Will Lipman Photography / Google

The cheapest option, but the one requiring the most effort, is to plug your finances into a spreadsheet by hand. Spend an hour in Google Sheets, Excel or Numbers and you’ll be able to knockout a half-decent budget that’ll last years. I built a spreadsheet that I used as a student and it’s still working well a decade later (albeit with modifications these days).

Obviously this is a lot of work, especially when there are apps and services that can do a lot of it automatically. But, speaking from experience, there’s something very rewarding about doing it yourself. If you’re struggling to build your own, here’s a sample sheet.

Get Google Sheets

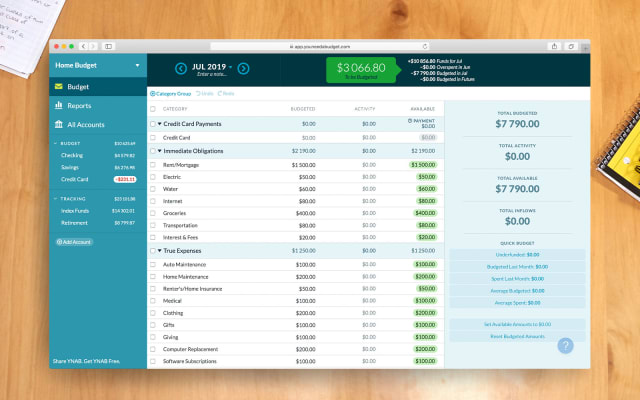

You Need a Budget

Will Lipman Photography / You Need a Budget

You Need a Budget (YNAB) is a popular money-management tool that’s available for Windows, macOS, iOS and Android. It’s based on Jesse Mechan’s budgeting system, which gets you working your way out of debt through a combination of smart management and saving. Mecham’s methods are unorthodox at first blush, but its users are often enthusiastic about how much good it’s done them.

YNAB asks you to plan for expenses based on the cash in your bank, rather than what you expect to have at the end of the month. And it tasks you with “aging” your money, keeping the cash in your bank until it’s more than 30 days old before spending it. If you can do that, it’s likely that your earnings are covering your spending and then some.

The platform offers goal tracking, education and a litany of live online video workshops laid on every week to help people grapple with their budgets. It costs $7 a month after an initial 34-day free trial, although the figure is taken as a $84 annual lump sum. Students, however, can get a full year of free service before having to pay, with the company saying if you aren’t satisfied, you get a full refund “no questions asked.”

Get YNAB

PocketGuard Plus

Will Lipman Photography / Pocketguard

PocketGuard’s big selling point isn’t to totally alter your financial habits but to act as an angel on your shoulder. Import your accounts and categorize your spending, and then the app can start doing things like adding spending limits to your budget. But there’s a much better reason to subscribe to PocketGuard: its ability to find financial products that are cheaper than what you’re using right now. And if that $4/month investment helps you save more in the future, it’s probably worth it. PocketGuard is available online, as well as with an iOS or Android app.

Get PocketGuard

Clarity Money

Will Lipman Photography / Goldman/Marcus

Clarity Money gathers all of your bank accounts in one place, so you can organize your cash more easily. It also looks through your spending and finds things you may not want to keep paying for, like lapsed subscriptions, and helps you cancel them. Even better, however, is the pledge to help you renegotiate your bills to try and get a better deal.

Clarity is owned by Marcus, the “new” bank launched by Goldman Sachs as a way of attracting new customers. When Goldman bought Clarity in 2018, both companies pledged that it would always remain a free product, although it’s more tightly integrated into Marcus now. And it’s available online, or through an iOS and Android app.

Get Clarity Money