Aspiration defies easy labels. It’s almost like this financial company is daring you to categorize it.It’s not a bank, though...

Insurance

Until recently, the goal of early retirement was a lofty one. But with the chaos caused by the coronavirus pandemic,...

View of Punta Ballena street in Magaluf, Baleares, Spain: EPAAll travellers from Spain to the UK must self-isolate at home...

costa del sol - franz marc/getty imagesWhen I booked flights to Spain in late June, just as the British Government...

(Bloomberg) -- It’s a hedge-fund summer idyll: Chickens strut, tomatoes grow ripe and the Atlantic breeze floats over this Hamptons...

Playa de Formentor, Mallorca, Spain: istockAround 500,000 British holidaymakers are believed to be in Spain.A further 1.6 million people are...

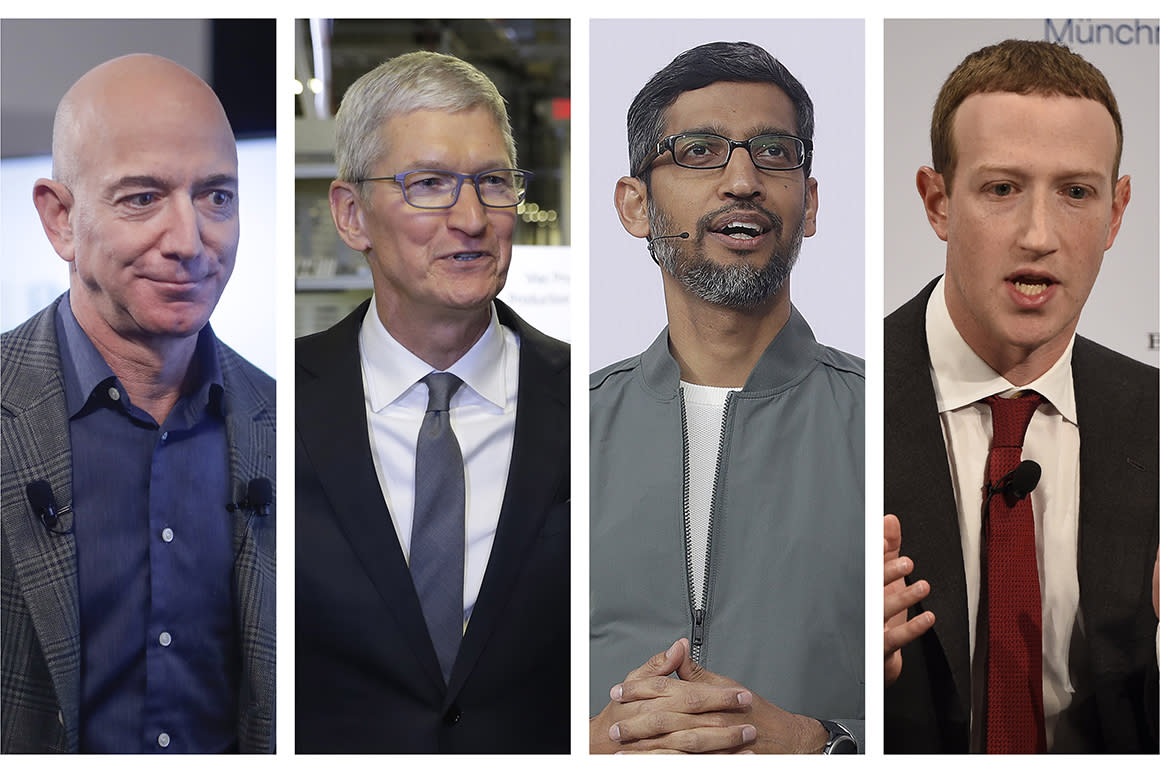

On Wednesday, four big tech CEOs — Apple’s Tim Cook, Amazon’s Jeff Bezos, Google’s Sundar Pichai and Facebook’s Mark Zuckerberg...

View of Punta Ballena street in Magaluf, Baleares, Spain: EPAAll travellers from Spain to the UK must self-isolate at home...

Both homebuyers and homeowners are loving today's record-breaking mortgage rates, which have been averaging less than 3% for the very...

SILVER SPRING, Md. (AP) — Less than two months after their office romance ended, Ahmad Kazzelbach began tampering with the...